All such events related to goods being returned are documented in the final accounts as they have a monetary impact. Accounts Payable Supply Company 165000.

Recording Purchase Of Office Supplies On Account Journal Entry

Only later did the company record them as expenses when they are used.

. When supplies are purchased they are recorded in the supplies on hand account. On January 3 2019 issues 20000 shares of common stock for cash. The purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry.

Journal entry for purchase returns or return outwards is explained further in this article. Paid 590 cash for office supplies that were previously purchased on account. Transactions and Journal Entry.

They also record the accounts payable as the purchase is made on the account. Also charging supplies to expense allows for the avoidance of the fees. To run successful operations a business needs to purchase raw material and manage its stock optimally throughout its operational cycle.

This is posted to the Cash T-account on the debit side left side. In case of a journal entry for cash purchase Cash account and. Solution On 1 st July 2019 when the goods were purchased on credit from the vendor then the purchases account will be debited in the books of accounts with the amount of such purchase and the corresponding credit will be.

The computers accumulated depreciation is 8000. Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase. In accounting the company usually records the office supplies bought in as the asset as they are not being used yet.

Gain on Asset Disposal. In simple terms when an organization or customer purchases the goods from the seller or supplier and agrees to pay the consideration value or price of the goods on some future date then it is called credit purchases. Prepare the general journal entry to record this transaction.

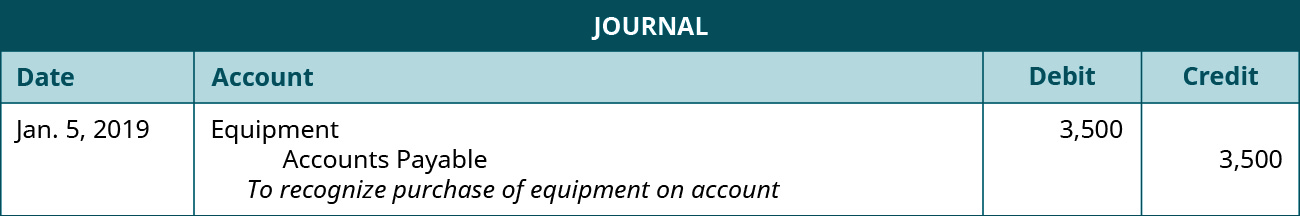

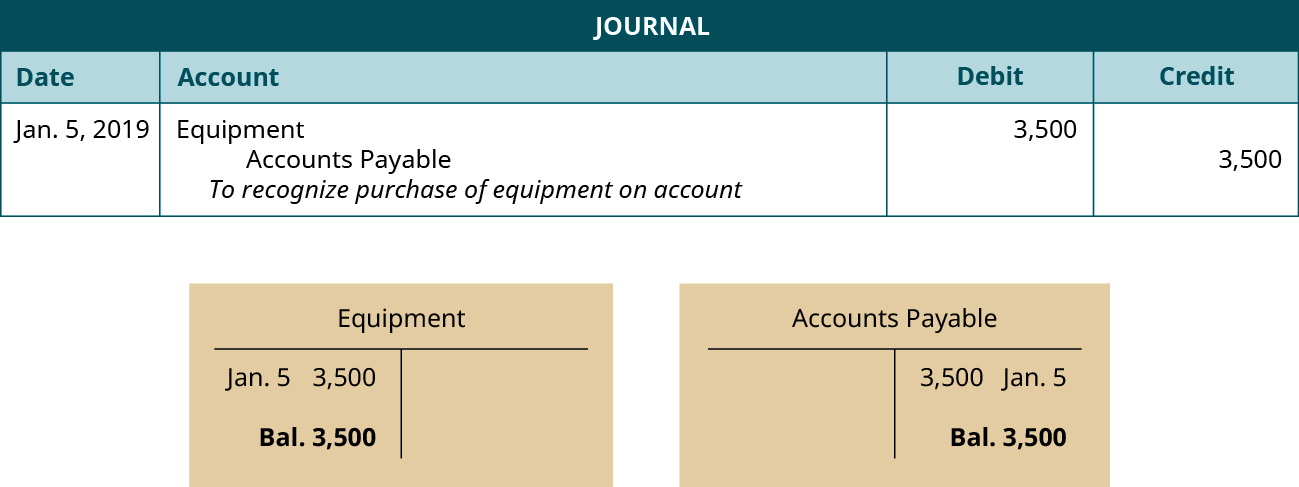

What journal entry will pass in the books of accounts to record the purchase of goods on credit and payment of cash against the purchase of those goods. Purchased Equipment on Account Journal Entry. Paid Cash for Supplies Journal Entry Example.

Office supplies used journal entry Overview. Third to record the cash payment on the credit purchase of supplies. When the company purchases equipment the accountant records it into the balance sheet under fixed assets section.

Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand. For example on March 18 2021 the company ABC purchases 1000 of office supplies by paying with cash immediately. Paid cash for supplies example.

In this case the company ABC can make the journal entry for the paid. Purchased Goods on Credit. Journal Entry for Credit Purchase and Cash Purchase.

The following are the journal entries recorded earlier for Printing Plus. To show this journal entry use four accounts. Journal entries are the way we capture the activity of our business.

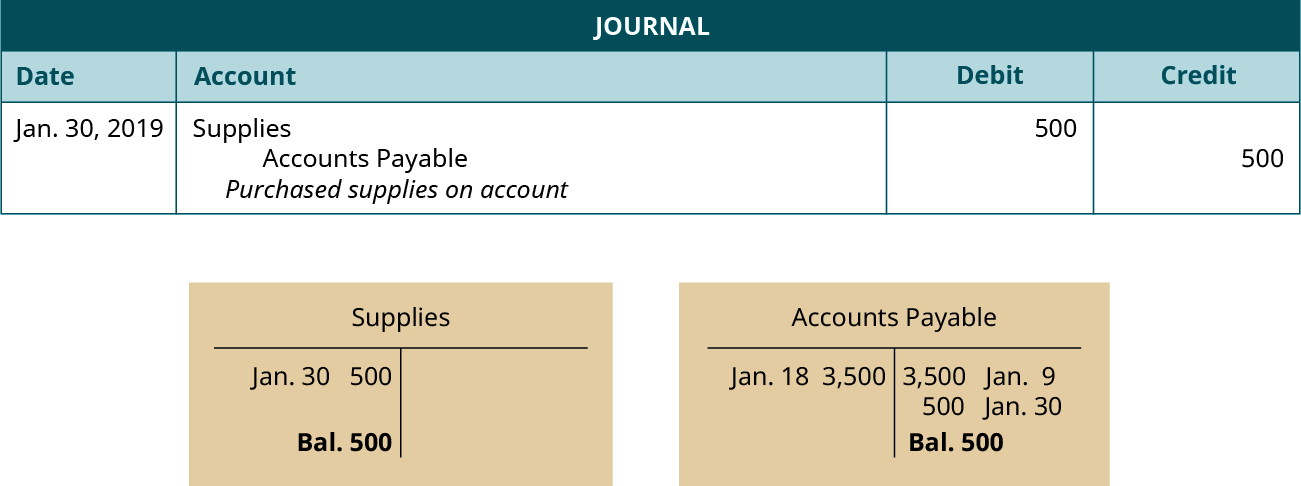

They need to settle the payable later. The company can make the journal entry for the bought supplies on credit by debiting the office supplies account and crediting the accounts payable. Supplies on hand journal entry.

For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total amount of 50 and pays for the items with cash. In the journal entry Cash has a debit of 20000. Debit your Cash account 4000 and debit your Accumulated Depreciation account 8000.

Likewise the office supplies used journal entry is usually made at the period end adjusting entry. This may happen due to several different reasons in business terminology this action is termed as purchase returns or return outwards. Accounts Payable Supply Company 20000.

Thus consuming supplies converts the supplies asset into an expense. Company ABC purchased Office supplies costing 2500 and paid in cash. Also charging supplies to expense allows for the avoidance of the fees.

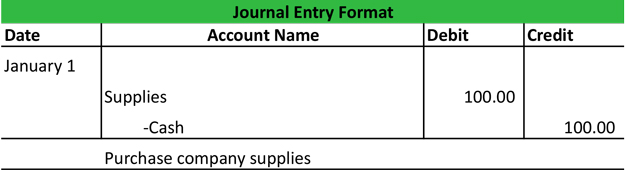

View Purchased office supplies costing 5200 on accountdocx from ACCOUNTACY 002 at Far Eastern University. Purchased supplies on account and recorded it in the inventory account. First to record the purchase of supplies on credit.

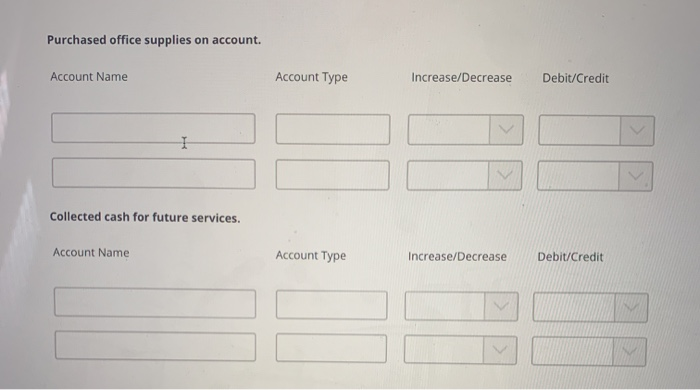

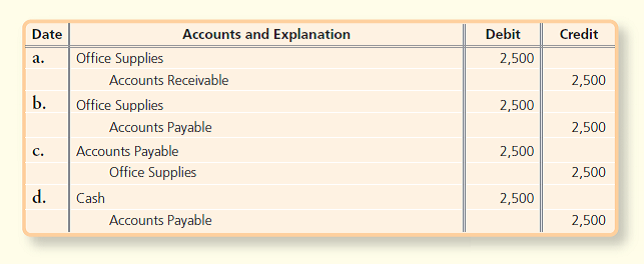

Accounting Your business purchased office supplies of 2500 on account. Whenever credit purchase takes place accounts payable accountsundry creditor is created. For example if a business purchases supplies of pens and stationery for 400 the journal entry to record this is as follows.

Accounts Payable Supply Company 185000. Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different accountThis lesson will cover how to create journal entries from business transactions. Common Stock has a credit balance of 20000.

Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. Of course the office supplies would be already debited at the date of the purchase with the credit of accounts payable when the company made a credit purchase. Office supplies used journal entry Overview.

Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase. Purchased Equipment on Account Journal Entry Equipment is the assets that company purchase for internal use with the purpose to support business activities. Lets say you sell your asset and end up making money.

Depending on the terms. Say you sell the computers for 4000. Purchase Of Office Supplies Journal Entry.

In this journal entry the office supplies account is an asset account on the balance sheet in which its normal balance is on the debit side. Second to record the return of supplies.

Answered Accounts And Explanation Debit Date Bartleby

Purchase Office Supplies On Account Double Entry Bookkeeping

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Business Events Transaction Journal Entry Format My Accounting Course

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Solved Purchased Office Supplies On Account Account Name Chegg Com

0 comments

Post a Comment